Some hedge funds use OTC products as part of their main investment strategy, or as a supplement to their main strategy. In either event, there are a number of issues which hedge fund managers should consider when they decide to utilize OTC products within an investment strategy. First and foremost, the OTC investment strategy should be adequately described in the hedge fund’s offering documents. Secondly, the manager should consider the “back office” requirements for processing the OTC investments. The following article gives a good background of the OTC processing requirements and issues.

Please contact us if you have any questions or you are interested in starting a hedge fund.

****

The 5 Pillars of OTC Processing

Ron Tannenbaum, co-founder, GlobeOp Financial Services

As the OTC derivatives market expands in volume, complexity and sector interest, many funds face equally complex post-trade processing challenges in terms of operational processes & efficiencies. Can the key elements of a successful operational infrastructure to support a competitive OTC strategy be defined?

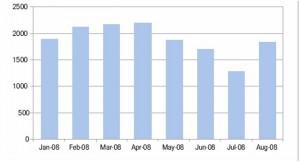

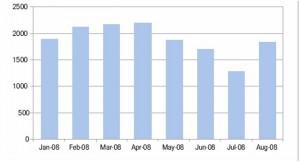

As a significant opportunity for alpha, the growing attraction of OTC derivatives is confirmed both at the industry level and on the “production floor”. Supplementing Morse’s recent focus group confirmation that 64% of firms increased derivative contracts volume in the last 6 months, new trades by GlobeOp’s OTC clients in the same period increased 100%; monthly open positions increased 18%.

GlobeOp: Daily Average OTC Trade Volume

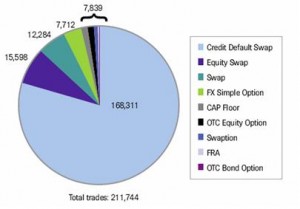

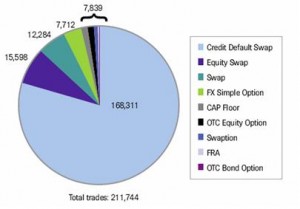

GlobeOp Monthly OTC open positions by Product Type, August 2008

In addition to traditional hedge fund activity, mutual funds liberated by the UCITS III directive are also increasingly including OTC derivatives in their trading strategies. Exponential OTC volume growth, combined with the current market turbulence, is challenging in-house operational systems as never before. Legacy and “bolt-on” software systems struggle to communicate with each other. Spreadsheets strain to handle volumes and complexity they were never designed for, increasing the risk of error with each update. In parallel with portfolios becoming more complex, funds are facing increased investor pressure to demonstrate enhanced operational control, independent valuation, higher levels of disclosure and more transparent performance reporting. For many funds, processing derivatives internally quickly becomes cumbersome, inefficient and error-prone, increasing operational risk instead of delivering competitive advantage.

Is a water-tight process for OTC trade processing possible and if so what would it look like?

Eight years of daily OTC processing has provided GlobeOp with a crystallized perspective of the elements essential to a fund’s requirement for effective OTC derivative post-trade processing. Five core, integrated processes are needed to manage, track and report on trades end–to-end throughout their lifecycle:

- Trade capture

- Operations

- Valuations

- Collateral management

- Documentation

Rigorous, reliable, daily reconciliation underpins much of the process, while scalability in terms of people and technology is needed to respond nimbly and promptly to trade volume growth, new products or unexpected market events.

The 5 Pillars

Trade capture – real-time, cross-product

Trade data entry sounds such a basic process that it is often underestimated as the cause of many issues further along the process. Incomplete and/or inaccurate detail risks being created when data is aggregated into an internal system from disparate silos or when bolt-on software is unable to communicate completely with front office configurations or legacy systems.

Also, due to their bilateral nature, derivative instruments do not always have established identifier codes, making them more difficult to process than securities with their standard ISIN, CUSIP or Bloomberg reference codes.

A real-time, cross-product, electronic trade capture environment can support the trading desk in developing and trading new OTC products. Trades should only ever be recorded once, to eliminate the risk of errors associated with manual entry and spreadsheets.

Operations – the litmus test

Trade operations are the ‘litmus test’ of the entire process, encompassing the settlement of trades and reconciliation of cash and securities positions associated with individual derivatives transactions. Having cash and securities obligations in position at the time of settlement are essential to efficiently transferring ownership and moving funds.

Valuations – transparency, independence

The challenge of accurate, independent valuation can be addressed by pricing models that can adapt to new and complex instruments, and that are tolerance-checked against counterparty prices and other external industry and data sources.

Depending only on counterparty prices due to either insufficient valuation expertise or technology can increase the risk of a domino of delays to timely and reliable trade reconciliation, NAVs and investor reporting or returns.

Mutual funds face an additional regulatory dimension to their valuation challenges. In exchange for reducing mutual fund barriers to OTC derivative trading, the February 2007 UCITS III directive placed a high premium on transparent and independent valuation and risk management.

The requirement for mutual funds to demonstrate their ability to provide fully independent daily valuations and risk analytics can affect both mutual funds and their custodian bank. A mutual fund’s back office is often well-equipped to manage the long-only investments the fund traditionally makes. Operational knowledge, systems, models and capacity for complex derivatives is, however, either absent or insufficient. This is compounded when, as we have seen repeatedly, most mutual funds also initially tend to significantly underestimate their derivative trading volume,

Thus challenged, and to meet the UCITS lll independence criteria, the mutual fund turns to its custodian bank, its historic provider of a wide range of support services. While willing in spirit, most custodian banks quickly recognize that complex OTC trade processing, valuation and risk analytics exceed both their expertise and spreadsheet-based systems.

Collateral management – exposure management

Current market turbulence has sharpened the spotlight on the value of real-time, online collateral management to accurate trading and exposure management. What collateral is on the books, with whom, at what rate, for how long? What pledges are held vs. outstanding? Accurate, transparent collateral reporting will remain vital to the front office for months to come.

Effective collateral management usually includes ensuring the fund is net present value collateralised with each of its counterparties on a daily basis. In addition, an integrated facility should ensure appropriate movement of cash and securities to support revaluations and margin calls.

Documentation – integrated STP

According to recent ISDA statistics, approximately 60% of the hedge fund industry’s OTC instruments are still confirmed manually. This is not only time-consuming, but it also increases the incidence of error and leaves funds vulnerable to compliance risk, due to the high level of positions which remain based on verbal agreements. Integrated, straight-through-processing (STP) for managing, exchanging and storing trade documentation better enables both trade partners to reconcile economic terms with counterparties and meet auditor and regulatory compliance obligations.

Conclusion

A successful OTC trading strategy requires underpinning by an integrated platform of people, processes and technology that deliver post-trade processing and reporting that enables the fund to focus on its core objective of generating investor returns and expanding the capital base.

Informal industry estimates indicate that building an internal OTC processing infrastructure involves significant fund investment in cost and time — up to $50 million and five years of testing and development. Often unspoken are the risks that continued market and fund strategy evolution may result in a design neither suitable or scalable for long-term requirements, or able to deliver sufficient economy of scale.

The attraction of OTC derivative instrument strategies remains robust. As funds consider their future strategies, recent market events have only served to reinforce the need for post-trade processing and infrastructures whose key deliverables are:

- Data and document management across the lifecycle of the trade that is timely, transparent, accurate, reconciled and real-time

- Robust, scalable, online support

- Independent, risk-based valuation that is tolerance-checked within well defined limits.